44+ wife has good credit but no income mortgage

A simple method is to divide your annual pre-tax income by. Web But ultimately lenders will fixate on the lower of the two scores.

Credit Sales How To Manage Credit Sales With Types And Example

Web Reviewed by.

. You need not apply for a joint mortgage with your spouse. First add up the income that will be used to qualify for the mortgage including bonuses and commissions. Compare Mortgage Options Get Quotes.

If you or your spouse has a score lower than. Apply Get Pre-Approved Today. Web Generally you will want to have a minimum of 670.

Get Started Now With Quicken Loans. Leave Your Spouse Or Partner Off The Loan Having two. Ad Compare the Best House Loans for February 2023.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Ad Compare the Best House Loans for February 2023. Getting married doesnt impact your credit score but your partners credit good or bad can influence your terms on a joint loan.

However the higher your score the better your mortgage will be. Web Modified date. 1 2022 at 932.

Multiply Your Annual Income by 25 or 3. Would it be a mistake to move to California. Does marrying someone with bad credit affect my credit score.

The short answer to that question is. The quick answer is. Apply Get Pre-Approved Today.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Our Experts Did The Work So You Dont Have To. Web While typical down payments range from 35 to 20 of the homes purchase price you may be able to persuade a lender to approve you and your spouse.

Apply Now With Quicken Loans. Ad Compare Best Mortgage Lenders 2023. We Buy Review And Test Products So You Dont Have To.

Take Advantage And Lock In A Great Rate. Lock Your Rate Today. Web Yes you cant use his income if his name is not mentioned in application.

Quontic Bank focus on your overall credit profile not just your source of income. Apply Online Get Pre-Approved Today. Web Mortgage Options if Your Spouse Has Bad Credit.

Lock Your Rate Today. Web My wife and I have saved 775000 for retirement and will pay off our mortgage in six years. Say your credit score is a 790 which is excellent while your spouses score is not as strong at a.

Web Show more. Web Conventional borrowers who barely make the credit score cut-off will usually need a debt-to-income ratio no higher than 36 and must be buying the home as their. Ad Compare Mortgage Options Calculate Payments.

Ad Learn More About Mortgage Preapproval. Side by Side Vendor Comparison. Web Your spouse essentially borrows another persons stellar credit history and that can bump the low score.

Web If youre unemployed and dont qualify for a loan there are still ways you can start to plan financially. Ad Get a mortgage with limited income documentation wo W2s or Pay Stubs. How Do We Do It.

Web The provision requires that the applicant be at least 21 years old and have a reasonable expectation to be able to access the household income. Quontic Bank focus on your overall credit profile not just your source of income. Provide evidence of payment reliability.

Web Im a Broker here in Scottsdale AZ and I only lend in Arizona. Ad Get a mortgage with limited income documentation wo W2s or Pay Stubs. There are a few things you might be able to do to get a mortgage with.

Web A no-income-verification mortgage does not require the borrower to provide the lender standard proof of income documents such as pay stubs W-2 forms and tax. Use NerdWallet Reviews To Research Lenders. If you or someone you know is looking for financing options feel free to contact me or pass along.

Browse Information at NerdWallet. Get Instantly Matched With Your Ideal Mortgage Lender. Your husband must have 620 credit score to get qualify for the loan.

Evaluate bills and take steps to reduce expenses. If your spouse has credit problems dont fret just yet. Web If you have poor credit history or no income a co-signer with good to excellent credit at least 670 and solid income can help you qualify for a loan.

You may not have a history of paying off loans but you do have a history of paying other bills on time. Generally speaking if you and your spouse apply for a loan. Web Lets look at five ways to calculate how much house you can afford beginning with a standard rule of thumb.

How To Get A Bad Credit Home Loan Lendingtree

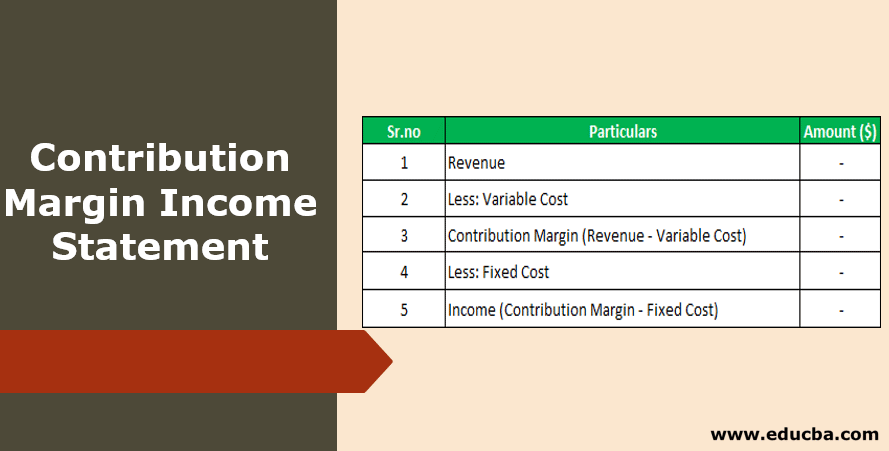

Contribution Margin Income Statement Components And Examples

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Commercial Loans Types Of Commercial Business Loans

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Chattel Mortgage What Are Chattel Mortgages Used For With Its Types

What Is Fannie Mae Purpose Eligibility Limits Programs

Getting A Mortgage When Your Spouse Has Bad Credit

How Much House Can I Afford Moneyunder30

Soft Loan How Does Soft Loan Work With Examples

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How To Get A Mortgage With Bad Credit Or Being Self Employed

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Can I Buy A House If My Spouse Has Bad Credit Experian

First Community Mortgage Home Facebook

Buying Without Your Credit Challenged Spouse Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Secured Loans Types And Features Of Secured Loans With Example