Capital gains tax calculator 2021

Your overall earnings determine how much of your capital. Our calculator can be.

2022 Capital Gains Tax Rates By State Smartasset

The following are some of the specific exclusions.

. Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the. The tax rate on most net capital gain is no higher than 15 for most individuals. How much you earn in total.

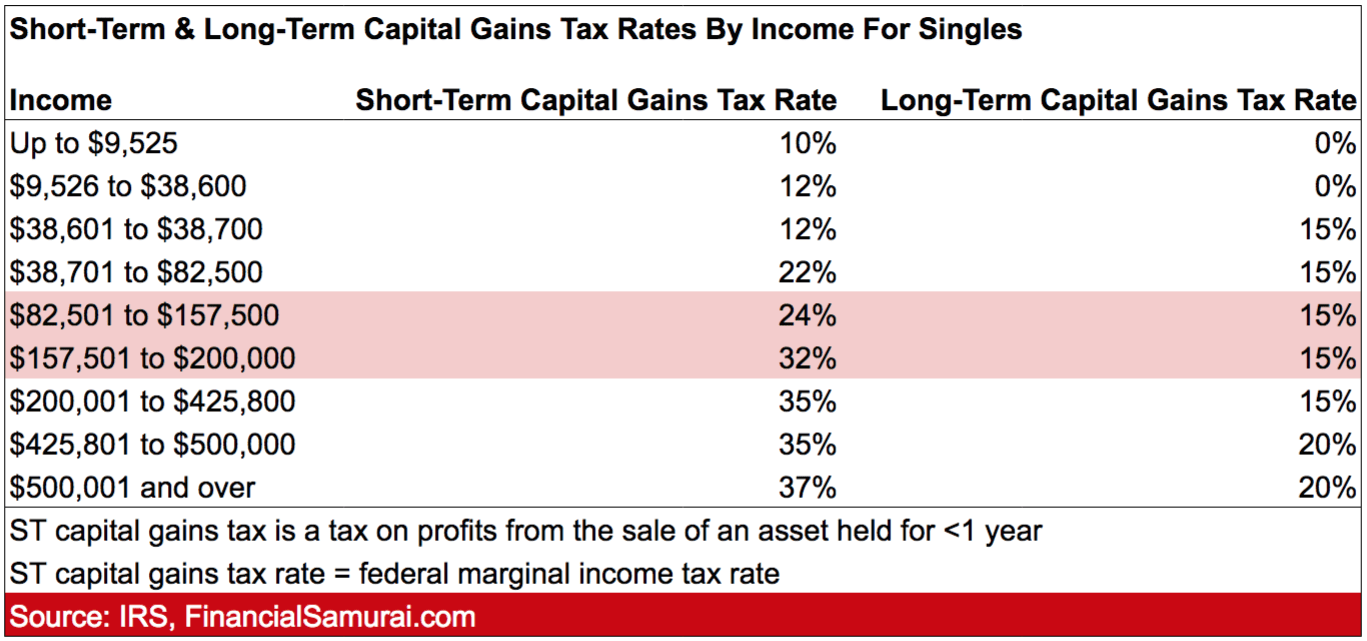

Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year. From this date Capital Gains are calculated at either an 18 or 28 tax rate dependent upon the amount of your other taxable income during the tax year. The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes rather than report these expenses from the state revenue.

John bought a house to rent out for 135k in March 2021 70 of which. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. If you have assets disposed before.

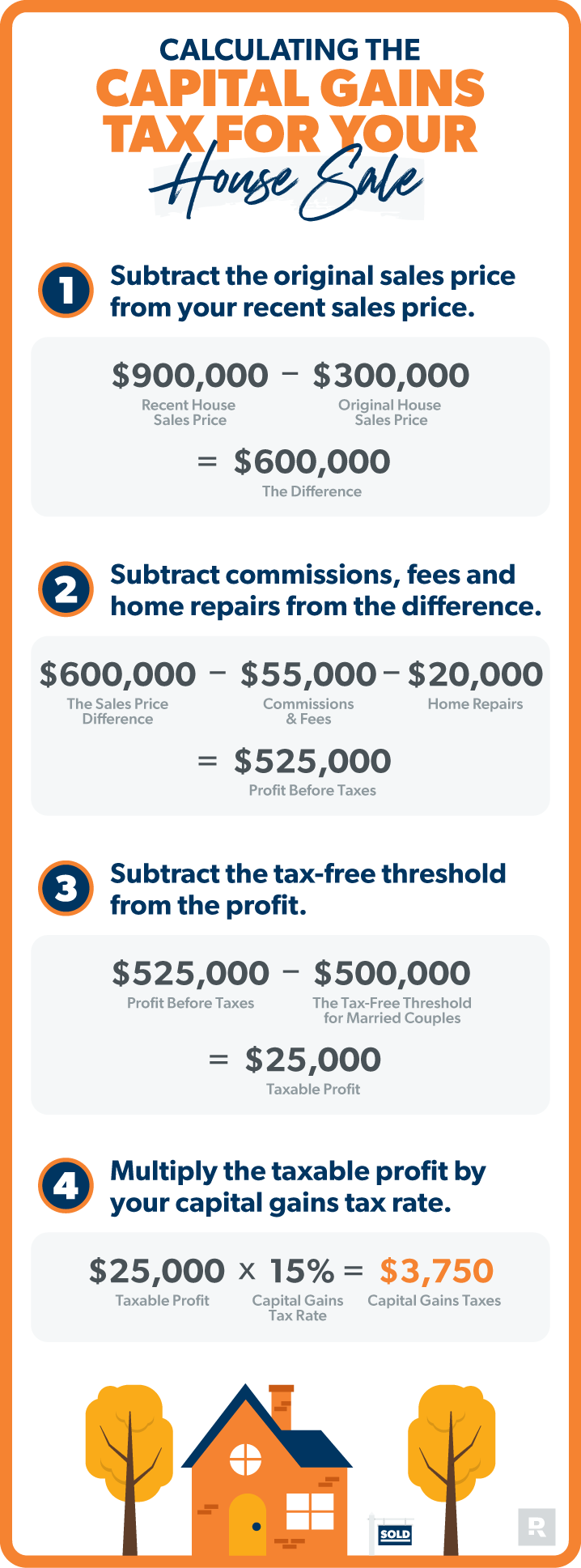

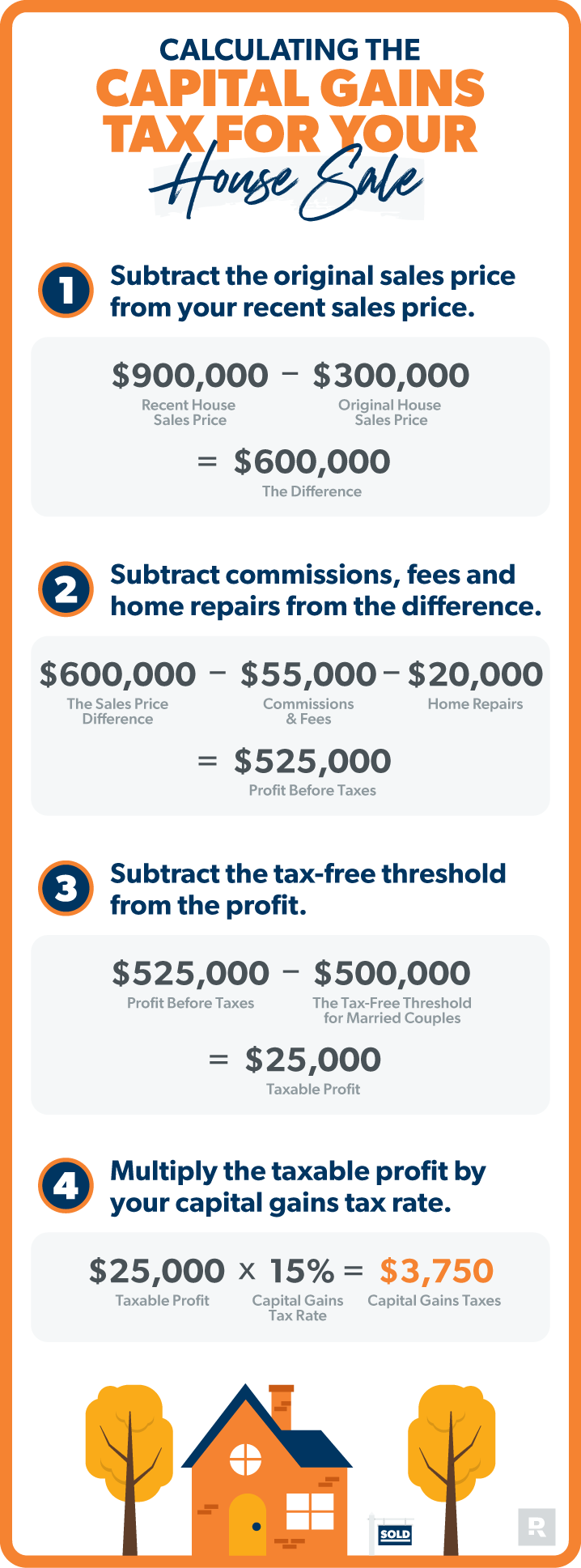

Capital Gains Tax Calculator Values. Calculations are estimates based on the tax law as of. Subtract the costs 2 from what you received 1.

Calculate the Capital Gains Tax due on the sale of your asset. Use our capital gains calculator to determine how much tax you might pay on sold assets. FAQ Blog Calculators Students Logbook Contact LOGIN.

For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any profits. Your total capital gains tax CGT owed depends on two main components. Weve got all the 2021 and 2022 capital gains.

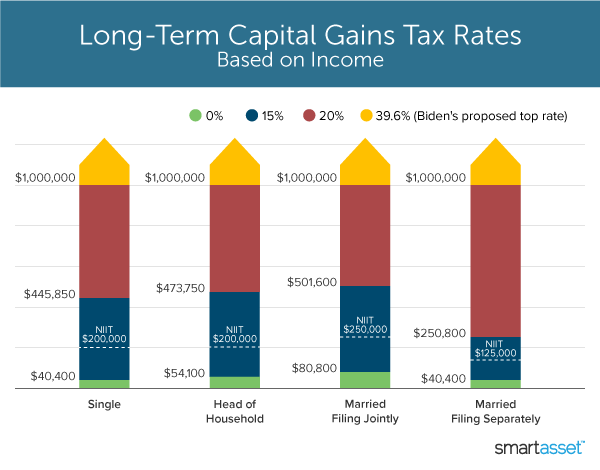

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Add this to your taxable. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for.

First deduct the Capital Gains tax-free allowance from your taxable gain. Calculate the Capital Gains Tax due on the sale of your asset. For this tool to work you first need to state.

What type of assets you sell. More than zero you have a capital gain for this asset. But there is an option for deferring capital gains taxes from the sale of an investment property by reinvesting the proceeds.

If the result is. Events that trigger a disposal include a sale donation exchange loss death and emigration. Less than zero you have a capital loss for this asset make sure.

Investors can lose over 37 of their capital gains to taxes. Sourced from the Australian Tax Office. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property.

Maximum Taxable Income Amount For Social Security Tax Fica

Verimli Giris Gizem Long Term Capital Gain Tax Calculator Raicolombia Com

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax What Is It When Do You Pay It

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Tax Calculator Estimate Your Income Tax For 2022 Free

Short Term Vs Long Term Capital Gains White Coat Investor

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Tax 101

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Capital Gain Tax Calculator 2022 2021

Short Term Vs Long Term Capital Gains White Coat Investor